In our ongoing analysis of radio performance for our long-time mobile app client, we've explored which channels deliver the most efficient customer acquisition. First, we established that radio was the top-performing channel in Q4 2024 (vs TV and OTT/CTV). Then, we broke down performance by daypart.

Now, we're diving into a key strategic question: Should advertisers focus on local or national radio buys?

The Methodology

Our client’s goal is to drive sign-ups and track user conversion over six weeks. We measure performance using promo code redemptions, the industry standard for direct response campaigns. (We went into a little more detail on this in the first post in the series, in case you missed it: Comparing Audio, TV, and OTT: How a $2 Million Investment Played Out).

To compare local and national radio, we looked at these three metrics:

- Sign-ups (users who registered after hearing the ad)

- Conversions (users who completed the key conversion event)

- Reach/CPM (cost efficiency and audience scale)

Our analysis also incorporates historical modeling to project longer-term revenue impact over one to two years.

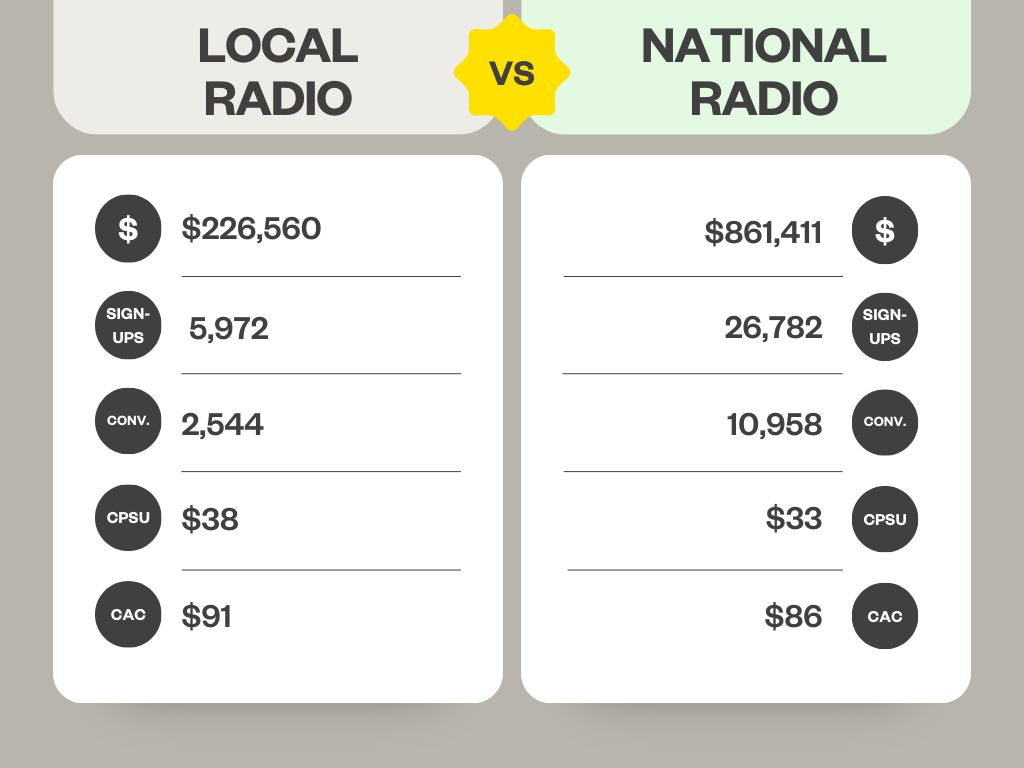

The Data: Local vs. National Performance (Q4 2024)

Key Takeaways

National Delivers Scale and Efficiency

- National radio buys consolidate groups of local stations by genre, offering built-in efficiencies.

- Lower Cost Per Sign-Up (CPSU) and Customer Acquisition Cost (CAC) make national radio a strong option for brands looking to maximize volume.

- However, advertisers must be mindful of product availability by market—if a brand only serves 40% of the country, national radio could waste impressions in non-serviceable areas.

Local Offers Precision at a Lower CPM

- Local radio allows advertisers to target high-value markets more effectively.

- With $4–6 CPMs, local buys deliver efficient reach but come with scale limitations.

- This approach makes sense for brands with regional availability or those prioritizing specific market penetration over broad awareness.

So, Which Is Better?

The data suggests that a hybrid approach is best for our mobile app client. This approach leverages national buys for efficiency while layering in local markets where conversions outperform the average.

As always, the answer depends on your business model. National radio is the more efficient path if your brand has nationwide availability and needs scale. But, a local strategy could yield better ROI if you’re only covering a portion of the country (or have key markets you’re targeting or where you know conversion rates are significantly higher).